kulutusluotto nordea | Nordea lainalaskuri

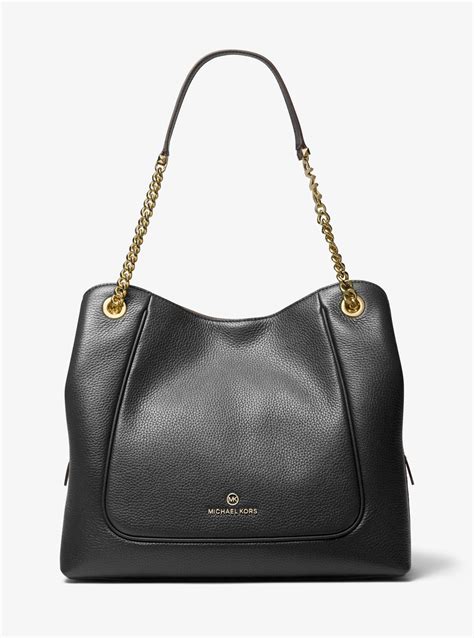

$115.00

In stock

Navigating the world of personal finance and securing the right consumer credit can be a daunting task. With numerous options available, understanding the nuances of each product and choosing the one that best aligns with your financial circumstances is crucial. If you're considering a consumer loan in Finland, Nordea, a leading Nordic financial services group, offers a range of solutions to meet diverse needs. This article provides a comprehensive overview of "Kulutusluotto Nordea" (Nordea Consumer Credit), encompassing its various features, application process, related tools like the Nordea loan calculator (Nordea lainalaskuri, Nordea rahoituslaskuri), and essential aspects such as Nordea's unsecured loan options (Nordea vakuudeton laina), security requirements (vakuudellinen kulutusluotto Nordea), and convenient services like Nordea e-invoice (Nordea e lasku) and Nordea e-payment (Nordea e maksu). We will also touch upon related services like Nordea's credit score (Nordea saldotodistus) and funds transfer capabilities (Nordea rahanlasku).

Understanding Kulutusluotto Nordea: Tailored Financial Solutionskulutusluotto nordea

"Kulutusluotto" directly translates to "consumer credit" in Finnish. Nordea offers various types of consumer credit, designed to help individuals finance a range of expenses, from home renovations and debt consolidation to unexpected bills and personal projects. These loans can be broadly categorized into:

* Unsecured Loans (Vakuudeton Laina): These loans don't require any collateral. Your creditworthiness and income determine the loan amount and interest rate. This type of loan is often favored for its flexibility and faster approval process. Nordea offers several unsecured loan products, each with its own terms and conditions.

* Secured Loans (Vakuudellinen Laina): These loans require collateral, typically in the form of real estate or other valuable assets. The collateral serves as security for the lender. Secured loans often come with lower interest rates and larger loan amounts compared to unsecured loans, as the lender's risk is reduced. While not strictly labeled "Kulutusluotto," leveraging existing assets for a loan through Nordea is a relevant option.

* Flexible Credit (Joustoluotto): This type of credit provides a revolving line of credit, allowing you to borrow funds as needed, up to a pre-approved limit. You only pay interest on the amount you actually borrow. This can be a useful option for managing unexpected expenses or for projects where the total cost is uncertain.

The Importance of the Nordea Loan Calculator (Lainalaskuri & Rahoituslaskuri)

Before applying for any type of consumer credit, it's crucial to understand the potential financial implications. Nordea provides a user-friendly loan calculator (Lainalaskuri) and a financial calculator (Rahoituslaskuri) on its website to assist you in this process. These tools allow you to:

* Calculate Monthly Payments: Enter the desired loan amount, interest rate, and loan term to estimate your monthly payments. This is critical for budgeting and ensuring you can comfortably afford the repayments.

* Determine Affordability: By adjusting the loan amount and term, you can assess how different scenarios would impact your monthly payments and overall loan cost. This helps you determine the maximum loan amount you can realistically handle.

* Compare Loan Options: Experiment with different interest rates and loan terms to compare the cost of various loan options. This allows you to identify the most cost-effective solution for your needs.

The extract provided emphasizes the importance of using the flexible credit calculator (Joustoluottolaskuri). It states: "Our flexible credit calculator helps you plan the size of consumer credit that would be suitable for your needs. Try the calculator and estimate what would be a suitable installment and repayment period for you." This highlights Nordea's commitment to empowering customers to make informed decisions about their borrowing. By using the calculator, you can gain a clear understanding of the total cost of borrowing and the potential impact on your finances.

Applying for Kulutusluotto Nordea: A Step-by-Step Guide

The application process for Kulutusluotto Nordea typically involves the following steps:

1. Assess Your Needs and Financial Situation: Before applying, carefully evaluate your financial needs and ability to repay the loan. Consider your income, expenses, and existing debts. Use the Nordea loan calculator to determine a suitable loan amount and repayment period.

2. Gather Required Documents: Prepare the necessary documents, which may include:

* Proof of identity (e.g., passport, driver's license)

* Proof of income (e.g., pay stubs, bank statements)

* Information about existing debts (e.g., loan statements)

* Details of any collateral (for secured loans)

3. Complete the Application: You can typically apply for Kulutusluotto Nordea online, at a Nordea branch, or by phone. The application will require you to provide personal information, financial details, and information about the loan you are seeking.

4. Credit Assessment: Nordea will conduct a credit assessment to evaluate your creditworthiness. This involves reviewing your credit history, income, and existing debts.

Additional information

| Dimensions | 7.8 × 4.4 × 1.4 in |

|---|